We’re currently with AA, who decided to increase prices by almost 10% for our upcoming renewal. Cove is much cheaper and has got good reviews, mainly about their website and sign up process. However I can’t find any reviews about their claims process. In the past AA has been very good for us whenever we had a claim. Anyone got experience claiming something with Cove?

In terms of claims paid out, it would be good to know companies’ premiums to claims paid out ratio is. For health insurance, there is a huge range. Southern Cross pays out around 86c for every dollar collected, compared to Nib’s 60c per dollar.

I have tried and failed to find data for other kids of insurance. I suspect because Southern Cross explicitly advertises their payout rate, other companies feel they need to provide that data as well. But for other types of insurance it’s just not publicly available.

Thanks for those stats! We have health insurance with AA which is underwritten by NIB. They are substantially cheaper than SC but have better terms for eg major surgery and cancer care, things we find important. We pay about $200 monthly for a family of four and it includes specialist care and has a $500 excess. SC for a similar plan was almost double.

But they must make up for the difference somehow. Do you have any explanation for this difference? I appreciate this is going off topic.

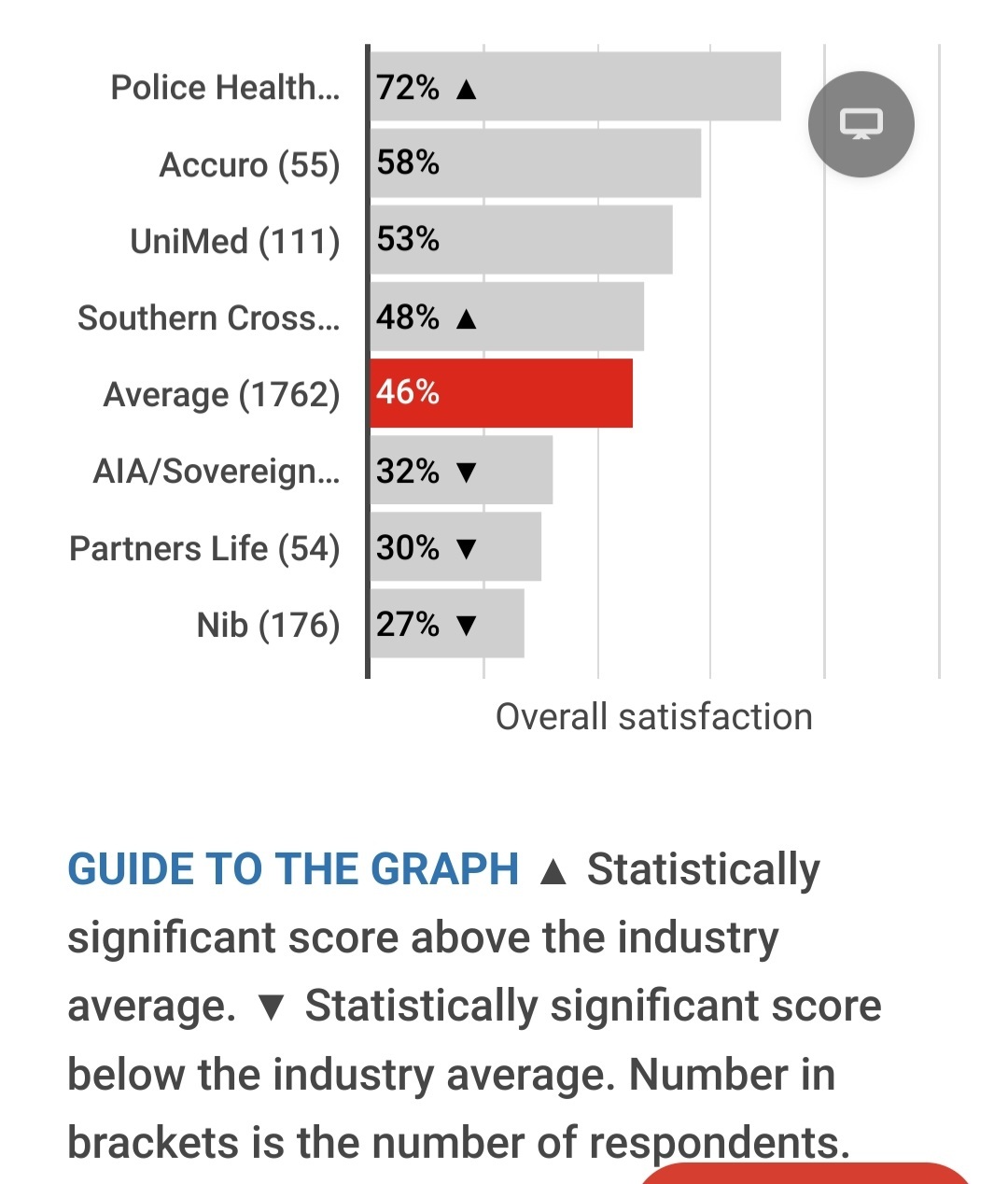

The stats come from Cosnsumer NZ, and you need an account to see it, but it’s not explained. It’s not in an easy to copy format (it’s a comparison tool), but I’ll copy the survey here. Nib had the worst satisfaction survey, which the article says was because of a poor claims experience. Personally I’d be worried about claims getting rejected, but I’ve never had to make a claim.

Here’s the survey article:

spoiler

We got quotes from six health insurers for surgical and medical cover for a male and female aged 35, 55 and 70, as well as for a family of four, with excesses of $0, $500 and $1000. You can see these quotes in the ‘Compare’ tab at the top of the page.

What we found

Of the policies surveyed, UniMed’s Hospital Select policy was significantly cheaper than the rest, however, it limits surgical cover to $300,000 and hospital medical cover to $65,000.

Only Southern Cross had lower medical cover across its policies, with the other insurers’ hospital medical coverage ranging from $300,000 to $500,000.

Accuro’s SmartCare+ offers $500,000 of hospital surgical cover, nib Ultimate Health Max and Partners Life’s Private Medical Cover offer $600,000 cover, while AIA’s Private Health Plus and Southern Cross’s Wellbeing Two offer unlimited cover. Age matters

For 35-year-olds, Partners Life and Southern Cross’s policies are the most expensive.

At 55, nib’s policy is the most expensive, with Southern Cross offering the most expensive policy at age 70.

Given the importance of continuous cover and pre-existing conditions, it’s worth making health insurance decisions with the long-term in mind. Partners Life is among the most expensive at 35, but by 55 it is mid-range, and by age 70 it is among the cheapest policies on the market. Gender matters too

Prices were generally higher for women aged 35 and 55 but for men at 70. Accuro and Southern Cross are the exceptions, with men and women paying the same price for health insurance at every age. Health insurance is rising faster than inflation

On average, the health insurance quotes we received have increased in price by 10.2% from October 2021 to January 2023, outstripping inflation over the same period, which stands at 8.8%. Costs are rising everywhere, but they’re rising faster in health insurance.

We asked the health insurers what was behind their rising prices, and the predominant theme was “medical inflation”.

Medical inflation refers to the rising cost of medical treatment. Innovation in healthcare creates better but more expensive treatments, drugs and technologies. We live longer due to these developments, but we are also more likely to require more medical care. Changes in our diets and lifestyles mean we are living with more chronic illnesses and increased rates of heart disease, cancer, diabetes and obesity.

While all insurers attributed their price increases to medical inflation, the extent of the increases and how they are applied differs significantly between providers. Accuro, AIA and Unimed have consistently applied increases across age and policy type, but while Unimed and AIA’s increases range between 8% and 9%, Accuro’s policies have increased by around 12%.

Other providers have adjusted prices differently depending on the policy and the age group. Southern Cross is among the only providers with price rises below inflation. Still, while the cost of its Ultracare policy for a 70-year-old has fallen by 1%, its Wellbeing Two policy with no excess has increased by 9% for the same person. Similarly, a nib Ultimate Health Max policy with a $1000 excess has increased in price by 13% for a 35-year-old male but 16% for a family of four.

Best and worst health insurance for customer satisfaction

Service is just as important as price when choosing an insurance company. We surveyed our members to find out how they rated their health insurance providers.

People’s Choice

Police Health Plan is the winner of our People’s Choice award. We give the People’s Choice award to providers that rate above average for customer satisfaction and meet our other performance criteria. Learn more about our award.

We surveyed 1773 Consumer members with health insurance to rate their overall satisfaction with their provider. In the past three years, 75% of the respondents had made a claim. Overall, 46% of respondents with health insurance were very satisfied with their insurer. Best health insurance providers

Southern Cross are New Zealand’s largest insurer, and they are also the best when it comes to making claims in the eyes of consumers. Results show 83% of Southern Cross customers who made a claim were very satisfied with how their claim was processed, with UniMed (81%) also performing strongly.

Southern Cross and UniMed were also the insurers with which respondents were least likely to have had a problem. Just 6% of Southern Cross and 5% of UniMed customers had experienced a problem compared to 19% for Partners Life. Worst health insurance providers

Partners Life and nib were the worst performers in this year’s survey.

Partners Life has experienced a significant decline in satisfaction, with 50% of those experiencing an issue with the provider naming expensive premiums as the problem.

nib’s problems lie in claims processing. Among customers who had made a claim, just 59% were very satisfied with how the claim was processed, with 19% saying that nib made a mistake with their claim.

With insurance, I’m aiming to cover what we can’t cover ourselves. We have a $1,000 excess and don’t have cover for doctor or specialist appointments which are all likely to be under a thousand too. It costs us $110 a month for 5 of us (though the third kid is free as per their policy). It’s also on a corporate discount through work, which will make it cheaper.

The article also noted the age can make a pig difference, with different insurers being better or worse at different ages (though with health insurance you kinda need to pick one and stay with it because of preexisting conditions).

Thanks for sharing this! I’m concerned about the low rating of NIB, so think we’ll switch to Southern Cross. The only annoying thing I’ve found with them is the low cancer cover ($60k for chemo, $10k for non-Pharmac). For $50 / month it can be increased to $300k cover.

You’re right, it doesn’t make much sense to have cover for specialist. So far the couple of times we’ve had a scan/xray it was always below our excess. We mainly want to have cover for very expensive treatments.

In my experience, chemo through the public system is both quick and free, with some exceptions for things like more experimental treatment or things like elective immunotherapy. But I’m not confident it would be covered anyway. I don’t know if immunotherapy counts as chemo or is covered at all. It’s something I’d be keen to understand.

We’ve had an unfair amount of cancer in our extended family over the past few years, and largely the public system has been quick and free. But there has also been a good experience in the private system for those who used it.

As I’ve mentioned, there has also been elective treatments like immunotherapy not strictly necessary, and BRAF for melanoma. These were both in the vicinity of $10k a month, but I’m not convinced it would be covered by any standard health insurence (happy to be proven wrong though).

I did a quick search and some non-pharmac medicines can cost up to $200k/year. Standard cover from SC is $10k… It’s $50 monthly extra to cover $300k.

Not sure about the therapies you mention though. However, I think e.g. SC would be better than AA Health/NIB, so for us still worth the switch.

Based on this article I’m not very confident in the public health system: https://www.newshub.co.nz/home/new-zealand/2023/10/cancer-patient-advocates-say-health-system-reforms-are-taking-far-too-long.html

Do you know what the criteria are for accessing unfunded medicines privately? Is it good enough that a doctor says it would be a good idea, or does it need to be a necessary part of treatment?

I’m keen for cover for the extra but I’ve found it hard to get info on what exactly is covered.

Yes, interesting question! I’ve asked Bing as I’m tired of reading all policies :)

For Southern Cross Wellbeing One, the eligibility requirements for non-pharmac medicines are:

- The medicines must be prescribed by a registered medical practitioner for the treatment of a covered condition.

- The medicines must be Medsafe approved but not funded by PHARMAC.

- The medicines must be administered in a recognised private hospital or by an Affiliated Provider.

- The medicines must be covered under the Cancer Assist benefit, which has a limit of $10,000 per claims year and is subject to prior approval.

A doctor prescription is not sufficient to claim for non-pharmac medicines. You also need to obtain prior approval from Southern Cross before you receive the treatment.

I can’t help, but would like to know as well. One of our cars is currently insured with Cove too.

I feel like I might have seen some comments about them on the PersonalFinanceNZ subreddit, if you don’t mind going back to reddit.

Oh, feel free to DM me your referral link, as I may sign up and I believe you’ll get a discount then?

Didn’t even realise they had a referral! I’ll find it and send it through thanks!

I just double checked the policy, and if I select the same amount of cover, additional items, Cove is about the same price as AA. So I won’t be switching.

No worries!

Just found out that on Feefo you can filter on people with claims. They don’t seem to have recent reviews, but the rest looks pretty solid: https://www.feefo.com/en-GB/reviews/cove-insurance?withMedia=false&timeFrame=ALL&displayFeedbackType=SERVICE&team-tags=Claims

Based on this Reddit post: https://www.reddit.com/r/PersonalFinanceNZ/comments/o12a5q/experience_with_cove_car_insurance/

I had a brief look through the reviews, everyone was happy with how good the website was or the customer service. No one seemed to have made a claim. It reminded me of this:

spoiler

Haha yes. I did find some older reviews with claims. After some better comparison I found they are not much cheaper so we stick with AA.

Interesting, I wonder if it’s location or car type? They are about $300 cheaper for us than AA. We’re AA members but have been changing insurance every period as there isn’t any discount for loyalty any more

It’s for a Leaf, for some reason they are more expensive to unsure.

Hmm weird ours is also a Leaf. IIRC at the question where it asks how many days do you use it a week, if I had it at 3-5 days it was cheaper than 6-7 days.

5 days is about right for us, plus I don’t know how they would verify how many days a week you’ve been using it?

We’re using it 6-7 days a week, and then the prices went up indeed, to same level as AA. AA doesn’t ask that question.

I don’t mind going back to Reddit. While I like Lemmy, it still doesn’t have the numbers & engagement as Reddit still has unfortunately. Thanks!